Cryptocurrency trading is driving up profits for investors, but fees can be the brakes slowing personal yields.

One way around that is by trading cryptocurrency on BitMax.io, a relatively new high-performance digital asset trading platform that services retail and institutional clients around the world.

Starting as a crypto-to-crypto exchange incorporated and headquartered in Singapore, BitMax has trading fees that are among the lowest in the industry for buyers and miners.

BitMax.io’s History

Launched in 2019 with the vision of supporting cryptocurrency innovation and the advancement of the digital asset trading ecosystem, BitMax offers multiple trading mode options across regular trading and margin trading and a tiered transaction fee schedule that allows makers and takers greater profitability.

BitMax’s founding partner and CEO is George Cao, who earned a doctorate in computer science from the University of Chicago after graduating from China University of Technology. Its chief operating officer is co-founder Ariel Ling.

Both quant trading veterans, they have built BitMax on a foundation of transparency and reliability with the aim of delivering high-quality client services and trading experiences.

Cryptocurrency Innovation

BitMax.io is quickly establishing itself as an institutional trading platform that includes a fiat-cryptocurrency exchange, a crypto-to-crypto exchange, trading in derivatives and futures, and margin trading on crypto assets with up to 10x leverage.

More than 100 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Altcoins, Stablecoins, and Platform Tokens, are represented on BitMax.io. The growth of cryptocurrency has accelerated in recent years, with the earliest crypto coin, Bitcoin, reaching more than $20,000 per coin in 2017, and after a dip, reaching more than $32,000 per coin in January 2021.

Top Features

Since its start, BitMax has held to its vision of offering the best of cryptocurrency trading. Some of our favorite features include:

Low Transaction Fees

We think the best feature of BitMax is that its tiered VIP transaction fee schedule offers low rates, allowing for more profits.

Within the BitMax platform, you can trade cryptocurrency for cryptocurrency or trade-in futures or derivatives. With the exponential growth of cryptocurrencies, investors are increasing their exposure to Bitcoin, Ethereum, and other cryptocurrencies. The lower rates make profits in your cryptocurrency trades larger.

No KYC

Another plus of BitMax is that it does not require “Know Your Customer” (KYC) immediately, which makes getting started on BitMax.io easy and fast. KYC is, for many institutions, a mandatory process of identifying and verifying the identity of the client when opening an account and periodically over time.

Because KYC is not required for BitMax.io, setting up an account has no identification hurdles. In cryptocurrency investing, speed can add up to greater profits.

Easy-to-Use App

Not long after its start, BitMax launched a smartphone app, making trading in cryptocurrency, derivatives, and futures easy from anywhere. The BitMax app is compatible with Android and Apple iPhones, and users report that it is easy to use even for beginners in cryptocurrency trading.

While other investment platforms are available as smartphone apps, the vast majority of them do not specialize in cryptocurrency or offer the speed or array of cryptocurrency options that BitMax.io does.

BitMax Transaction Fees

Transaction fees in cryptocurrency trading can jump when the coin value does. Average transaction fees measure the average fee in U.S. dollars when a transaction is processed by a miner and confirmed. In the 2017 cryptocurrency boom, these rates reached nearly $60.

These fees can be volatile. Fees in early 2020 were around 0.60, but now, in early 2021, they are around $10.

The tiered transaction fee schedule of BitMax can be a small fraction of those trading fees. Without the higher trading costs, clear profit is left, especially at a time of growth for cryptocurrencies.

As an innovator in digital finance, BitMax.io listed e-Money, a blockchain-based electronic payment system collateralized with currency-backed Stablecoins, as an exclusive primary listing in early 2020.

Customer Support

BitMax.io’s customer support can be reached by submitting a request on the platform’s website or app, and an email contact will work as well.

As some of BitMax’s correspondence may be in Chinese, allow time for a translation of your request. As the development of BitMax progresses, response time is expected to decrease.

BitMax Innovation

New Listings

As an innovator in cryptocurrency, BitMax has announced a number of new listings since its inception. This offers new opportunities to investors early in the game, when these listings may be more profitable. Purchasing them at a lower price will bring a greater benefit over time with the growth of the listings.

Among BitMax’s listings from the past year was FLEX, the native token of CoinFLEX, the world’s first exchange to offer a physical delivery for Bitcoin futures contracts. The listing shows the shared vision of BitMax and CoinFLEX to support market growth and structure of the digital assets market.

The listing of STPT, the native token of Standard Tokenization Protocol, a decentralized network for the tokenization of any asset, followed. BitMax’s team assisted STP in the platform launch. STP-Standard is an open-source standard that defines how tokenized assets are generated, issued, sent, and received while complying with all necessary regulations. The protocol allows assets to be exchanged for tokens.

The Associated Press reported in March 2020 that CasperLabs, a proof-of-stake blockchain proven to be secure and scalable, is collaborating with BitMax.io to conduct its private validator token sale as an exchange validator offering. The EVO goal was to promote network decentralization by providing fair access to retail participants at the earliest stage, which would allow those early investors a chance at greater profits.

In the offering, CLX tokens from CasperLabs’ blockchain, were sold in rounds, with registration for EVO participation flowing through the BitMax.io platform.

Bitcoin and Alternatives

Since the advent of Bitcoin, the world’s first cryptocurrency, in 2009, digital assets have become an asset class for investing. The field of cryptocurrencies is expanding rapidly in market capitalization and popularity among investors, who favor it for profits and because these coins are usually free from government control.

In the past decade, other digital currencies have been created, offering benefits that Bitcoin does not. Ethereum, for example, offers a suite of financial products including accounts, loans, and insurance that anyone in the world can have free access to, regardless of nationality, ethnicity, or faith.

Litecoin, another early crypto option, is based on an open-source global payment network that is not controlled by any government. It is similar to Bitcoin, but it’s faster block generation rate gives Litecoin transaction confirmations.

Myriad altcoin options have been created since cryptocurrency’s early days. These altcoins often have newer features than Bitcoin, such as the ability to handle more transactions per second.

Proof-of-Stake vs. Proof-of-Work

Some cryptocurrencies use different algorithms, such as proof-of-stake. This theory holds that an investor can mine block transactions according to the ratio of coins held.

Proof-of-stake is an alternative to the Bitcoin algorithm, known as proof-of-work. The downside of proof-of-work is that it requires miners to ultimately pay for the computing power and electricity needed for mining. Proof-of-stake awards power based on the percentage of coins held by a miner.

Some options use a hybrid of the two. Ethereum, Investopedia reports, is in the process of switching to a proof-of-stake algorithm. Others using the algorithm include NXT, Blackcoin, Peercoin, and ShadowCoin.

We think it’s important for cryptocurrency investors to have access to an array of digital asset options, including ones that are newer and innovative. This allows savvy investors to get in on the ground floor, investing early when prices tend to be lower. Thankfully, BitMax.io offers more than 100 cryptocurrencies along with digital derivatives and futures.

Bottom Line

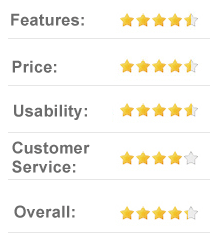

Trading in cryptocurrencies, derivatives, and futures as well as trading in digital assets on margin are among the riskiest investments, but they can also be lucrative.

BitMax.io is easy to use for beginners, and for those who can accept a certain level of risk, using BitMax can be more profitable than trading on other platforms since BitMax’s transaction fees are among the lowest in the industry.

Because it does not require identification verification, BitMax makes opening an account fast and easy.

An array of more than 100 cryptocurrencies are open for trading in this crypto-to-crypto platform, and cryptocurrency trading on margin with leverage of up to 10x is available. Derivatives and futures in digital assets round out trading options.

Interest rates are at historic lows, so savings accounts and certificates of deposit are not even keeping up with inflation when it comes to growth. Given high valuations of traditional investments, such as stocks and exchange-traded funds, and low yields from more conservative options such as bonds, now may be the right time to consider cryptocurrency investments.

Though trades of this type can be risky, and there is always the possibility of losing funds, BitMax opens the door to crypto trading for those who are experienced cryptocurrency traders or would like to learn.