CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Upto 83.51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Capital.com is a global CFD broker with offices in all corners of the world. They rely on an A.I.-enabled tech to provide “the world’s best trading experience,” including a plethora of educational information to support traders at all levels of experience.

We know that finances are complicated and that trading is one of the most involved, least understood aspects of the industry. It’s difficult to select a broker, especially when you’re looking to deal internationally, so we dug a little deeper into Capital.com. Here’s what we found.

About Capital.com

Capital.com provides a higher level, customized approach to financial trading with its web platform and artificial intelligence-driven app. They allow clients to choose from a variety of currencies and markets, including CFDs on Forex pairs, indices, commodities, stocks, and cryptocurrencies.

Founded in 2016, Capital.com initially struggled a bit, but then rapidly expanded to become one of the premier online brokers in the world. With offices in London (U.K.), Cyprus, Dubai, Australia and more, they boast more than 480,000 clients around the world, excluding the United States and Canada.

Capital.com Group is regulated and authorised locally in the United Arab Emirates, United Kingdom, Cyprus, Australia and Bahamas. They are very popular in the United Kingdom and in Europe because, in contrast to many other brokers, Capital.com is licensed and regulated in these jurisdictions. The company has worked hard to establish its reputation as an easy-to-use, reliable broker.

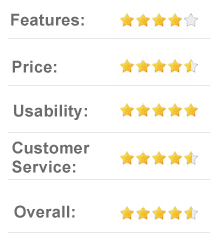

Capital.com’s Top Features

Modes of Trading

Capital.com has a web trading platform and mobile app that are both proprietary and loaded with tools for traders. As long as you have an internet connection, you can trade (and learn) from Capital.com.

Both the web platform and mobile app are user-friendly and accessible. They both include helpful features and useful information, run smoothly, and appear aesthetically pleasing.

Of note, the web platform provides some additional features, including most traded assets, risers and fallers of the day, and the most volatile assets. The app contains additional educational information, including tutorials, basic concepts, and a news feed.

Client Education

Perhaps the biggest perk to using Capital.com is their client education. They offer a glossary of terms, access to trading courses, webinars, and a news section with daily updates.

What if you’re new to the trading game? Capital.com has you covered. Newbies and amateurs will love Investmate. The app you learn the basics of trading through a variety of educational materials, including quizzes, tips, and interactive tasks.

Investmate makes it easy to learn trading. There are more than 30 courses broken into digestible sections. The individual guided lessons don’t take long, and you can flag interesting parts to revisit later.

How Capital.com Works

Registering is easy and only takes a few minutes. Don’t expect to start trading immediately, though. The company also requires you to verify your identity and address.

Proof of identity requires a passport, national ID document, or driver’s license. To verify your address, you can provide one of several documents, including a bank statement, utility bill, or tax statement.

Once they receive and approve your documents, you can start trading. You also gain access to their demo accounts and other customer-exclusive materials.

You have several options for making the initial deposit, including a debit card, credit card, bank wire transfer, Sofort, iDeal, Giropay, Multibanko, or Trustly. After the initial setup, it’s easy to make deposits and withdrawals using any of the above options plus Neteller or Skrill.

Overall, the trading process is easy to navigate, and their extensive library of educational materials is impressive. If you get stuck somewhere, it’s easy to reach customer support for the assistance you need.

What Capital.com Costs

Since we’re talking about trading, the money aspect is critical. How much does it cost to start, what are the fees, and what don’t they tell you?

How Much Does It Cost to Start?

To start trading with Capital.com, you need a minimum deposit of 20 USD, 20 GBP, or 100 PLN, when paying by Credit Card. If using wire transfer, the minimum is 250 EUR. Each tier adds benefits ranging from custom analytics to special events and webinars.

What About Fees?

A significant plus for Capital.com is that they do not charge a commission on trades. You can also make deposits or withdrawals for free. Understanding how they handle fees is a little more complicated, but the company is very transparent about their pricing model, which includes spreads and overnight fees.

Capital.com charges a spread for each trade. They are competitive in this area, and openly list the spreads on each market page.

The only regular fees you need to worry about are overnight fees, which you only incur if you leave a charge open overnight. Again, each market’s fees appear on their individual pages.

If you are judged to be an inactive client, Capital.com may charge you an inactivity fee as per their terms and conditions. An inactive client is generally when you haven’t used your account for 1 year or more.

What Don’t They Tell You?

Honestly, Capital.com appears to be transparent and reliable. We found answers to all of our questions on their page, which is easy to navigate. In fact, we stumbled on some bonus information that piqued our interest and knocked the company up a notch in our book.

Capital.com uses segregated bank accounts, so client funds remain separate from the broker’s operating funds. If you’re new to trading, it means they have a more secure process.

It may seem strange, but we also appreciated that they don’t use bonuses, gimmicks, or promotions to draw customers to their site. Digging a little deeper, it’s refreshing and comforting to know they don’t rely on tricks to mask underlying quality issues. They do have a volume-based cash rebate for professional clients, though.

Criticism of Capital.com

Things started a little slowly for Capital.com, but they appear to be past those growing pains. There’s not a lot to complain about these days, but a few tweaks could really push this broker to the top.

First, and most disappointing, Capital.com is not available in the United States. That’s a massive demographic to miss out on, especially when they accept the American dollar, and you can trade in American markets.

The other area that could use a little improvement is the variety of tradable assets. While 3,000+ assets seem like a lot, many of their competitors offer more. We’re hoping that Capital.com will grow their assets over the next few years.

We did a little digging to see what other users thought of their experiences with Capital.com, and they have a lot of positive feedback. Several of the negative reviews we found appeared to be related to questionable activity by the user that resulted in account suspension.

Customer Support

For an online platform, Capital.com is surprisingly accessible. They are available to customers 24 hours per day, seven days per week in 13 languages. You can reach them via online chat, messenger, phone, and email.

Capital.com claims to respond to emails within 24 hours. We didn’t try emailing, so we can’t verify that, but we did hop on their live chat to ask a few questions. They responded quickly, succinctly, and the interaction was pleasant enough for virtual communication.

Based on our research, users commend their customer service and support. There are several notes about quick, straightforward responses to inquiries, deposits, and withdrawals.

Final Thoughts on Capital.com

The combination of cutting-edge technology and extensive educational materials helps traders enhance their trading skills. There’s plenty of room for growth, but they already have a lot to offer their client base.

Whether you’re a newbie ready to dip your toe into the trading pool or an experienced trader looking for something new, Capital.com is a reliable choice. If you’re in the market for an online broker, this company is worth a look.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Upto 83.51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.