There are many different directions you can go when starting to manage your money and invest. PersonalCapital.com is a great online option for beginning the investment process. They have tools to help you achieve both your short and long term financial plans.

Financial planning is a topic many people push off since retirement feels so far away. However, financial planning is not just for retirement. It can help you with short term goals as well as your long term goals for retirement.

About Personal Capital

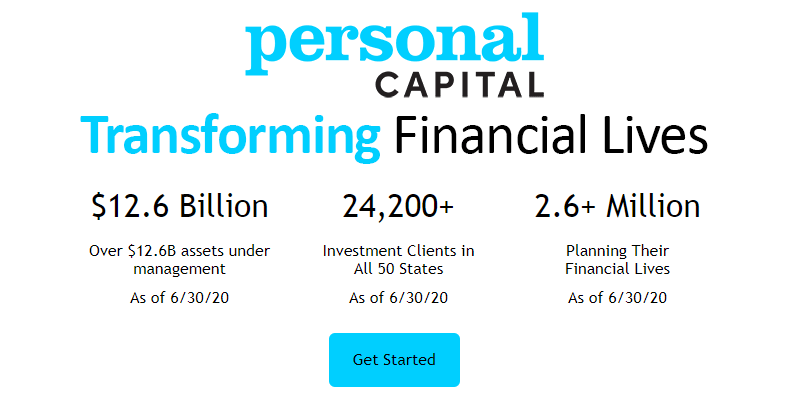

PersonalCapital.com was founded in 2009 by four gentlemen, Bill Harris, Rob Foregger, Paul Bergholm, and Loui Gasparini. The company went public on September 9, 2011. Currently, they manage $12.3 billion in assets, with over 22,000 clients in 50 states. Over 2.4 million people use Personal Capital to help plan their financial futures.

They are headquartered in Redwood Shores and have physical offices in San Francisco, Denver, Dallas, and Atlanta.

Services Offered

Personal Capital has three main offerings:

|

|

|

Each of these services comes with the assistance and knowledge of Personal Capital advisors. With an advisor, you can tailor your plan to your financial wants and needs.

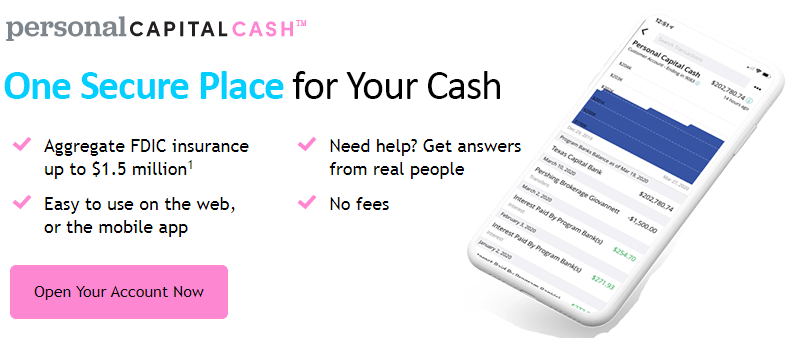

Personal Capital Cash

Personal Capital cash is a more useful version of a checking or savings account that you may have with a traditional bank. The twist is with this account; your money will earn you more money since the account has a higher interest rate. You will earn .05% APY on all your cash accounts.

Your money will earn interest daily after it has been in the account for around 2-3 business days. The total interest accrued will be paid on the first business day of the month. It deposits automatically into your account, so you do not have to lift a finger.

Account Structure

Contrary to many traditional bank accounts, Personal Capital does not require you to carry a minimum daily balance. They also do not place any limits on how many deposits you may have nor how many withdrawals in a given year; however, there are daily withdrawal limits of $25,000. Deposits are limited to $250,000 per transaction.

Accessing your money can be done via your dashboard on either the website or mobile app. Personal Capital allows ACH transfers. However, all deposits and withdrawals have to originate from their dashboard.

Your employer can deposit funds directly into your account, which saves you the step of having your paycheck deposited into a traditional bank account and then transferring it over to your high yield account.

However, if you prefer, you can go that route and link your traditional bank account to your Personal Capital account. You then would initiate transfers via your dashboard. They also have the option of making a wire transfer either to or from your account. The transfer limit is $1 million.

The one downside to only having an account through personal Capital is that they do not have an option for bill pay or debit cards. These options are something that may be available in the future. They do seem very open to suggestions and welcome you to let them know if there is a feature or product that you feel is missing.

If you are concerned about whether your money is safe, the program is insured by the FDIC for up to $1.5 million which is higher than traditional banks who generally only insure up to $250,000.

Wealth Management

Personal Capital’s wealth management program offers you a technologically advanced way to manage your money and grow your investments. They do this with a combination of highly acclaimed technology as well as their financial tools. The company has financial advisors who will assist you in planning and will help you make decisions for your financial future.

Philosophy

They believe in having a personalized strategy for each of their clients based on needs and preferences. Your advisor will help you set up a plan so you can achieve your goals. Within that strategy, they will take into account all the asset classes to make the highest return possible for the lowest risk on your part.

Personal Capital also uses its Smart Weighting approach to make better investment decisions for you by having a balanced exposure within your portfolio to all sectors and styles. They are not hunting for the next Netflix or Amazon. Instead, they are looking for companies that post consistent returns.

Your advisor will be there for you as an open communication partner, all set to the frequency of your choosing. You will not hear from them any more of less than you specify. They also will be a second set of eyes and ears watching over your investments, ensuring that your selections remain aligned with your current needs and strategy set in place.

Account Levels

Personal Capital has a few different account offerings based on the number of funds you want to invest in their program. To open a wealth management account, you need a minimum of $100,000.

There are three tiers of management services based on your total funds. If your Capital is between $100,000 and $200,000, you get to invest in ETFs that are tax-efficient. If your investment capabilities are in the $200,000 to $1 million range, you can customize your portfolio with both ETFs and individually traded stock options.

They do have a third tier as well. If your assets top out at $1 million or more, you also get to add investing in bonds to your portfolio.

Fee Structure

Personal Capitals fee structure is straightforward. It is based on a percentage scale in direct relation to the amount of money you have invested with them. Your first million invested has a fee of 0.89%. Once you invest $1 million or more:

|

|

|

|

Fees are billed on a monthly basis. There are no trade commissions, and includes everything in that fee. There are no additional costs on top of this percentage, and they offer many free services on top of their paid services.

What Institution Holds the Funds?

As you go through Personal Capital’s four-step process to set up your investment account and strategy, you will notice that it includes setting up an account for you at Pershing. Pershing Advisor Solutions is the company that holds all of the funds. Pershing is a part of the New York Mellon Company and has been in the industry for many years, holding a trillion dollars in assets.

With Pershing as a third-party custodian, Personal Capital does not hold your assets directly, which gives you better access to your money. You can monitor your investments at all times directly through Pershing’s site, or you can log into your Personal Capital dashboard on any supported device, whether it be your phone, tablet, or computer.

Investment Types

All investing is customized for you and your financial situation. Personal Capital leverages that with your financial goals using their algorithms to find you the best selection. For US equities, they have at least 70 stocks to choose from, which they pick using their Tactical Weighting approach. They also select based on optimizing for taxes.

If you are on a fixed income, they have options for you as well. They have a pick of low-cost exchange-traded funds, which they say allows for optimal diversification, all while keeping the overall costs of the funds low.

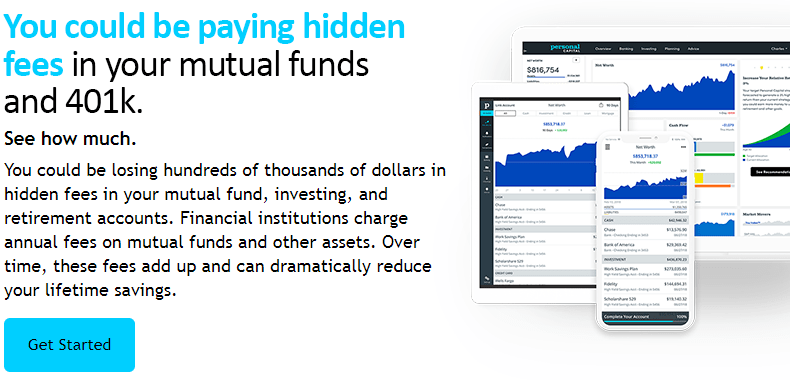

Additional Financial Tools

On top of their account and wealth management offerings, Personal Capital has many free tools for you to utilize. Their app allows you a birds eye view of all your accounts, lets you plan for retirement, and always monitor your investments.

They also offer investment checkup, 401k fee analyzer, and a handy spending tracker, so you know exactly where your money goes each month and adjust as needed. Just link your accounts after signing up, and you will be able to monitor all your assets in one spot.

The free retirement planner will help you to track what you have saved for retirement thus far and give you an estimate of what your monthly income will be at your retirement date. They also offer plenty of valuable advice on their blogs so you can continue to DIY your investing.

Final Thoughts

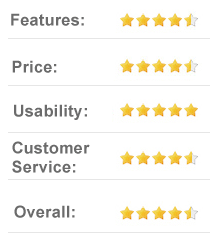

Personal Capital offers many free tools that allow you to take control of your financial future. With the ability to utilize many of their tools to analyze your net worth, budget, and track your spending all in-app form, you can move closer to your financial goals on your own.

Personal Cash Management accounts provide a secure place for you to save money while it continues to make you more. For some, the wealth management fees may seem a bit high, however, with the tools they offer, plus access to advisors and proprietary investment technology is worth it in the long run.