Robinhood is a user-friendly investment and trading app. It’s designed to make trading stock, ETF, options, and cryptocurrency easy, particularly for users new to the stock market. But that doesn’t make it less effective; a $1,500 investment with Robinhood could make you rich.

History of Robinhood.com

Founded in 2013, college classmates Baiju and Vlad thought of Robinhood’s concept while at Stanford University. It frustrated them that Wall Street firms paid little to trade stocks while the average American pays per trade.

So, with the vision to support the underdog, they built Robinhood Financial. Their success has been astounding. Despite the pandemic, Robinhood trading increased in 2020, and they raised $480 million in funding.

Top Features of Robinhood.com

Robinhood is designed to make investing fun and easy for you, the user. The most significant benefits to using Robinhood.com include:

- No minimum account balance, so you won’t be penalized for having $0 in your account.

- Commission-free trading on stocks, options, ETFs, and cryptocurrency.

- High-yield savings account.

- A user-friendly interface ideal for mobile phone users.

- Features like mobile alerts, candlestick charts, and news feed.

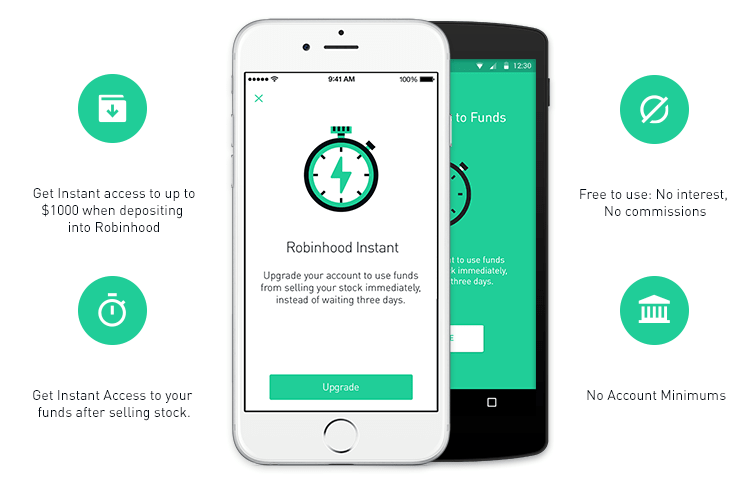

- Robinhood Instant allows you to trade immediately.

- Cryptocurrency trading.

Let’s take a closer look at these.

No Minimum Account Balance

Do you only have one dollar to invest in? With Robinhood, that’s okay! Unlike larger brokerage companies, you don’t need to maintain a minimum dollar amount in your account to invest.

The exception to this is if you open a margin account since a $2,000 minimum balance is required. But this isn’t a Robinhood rule—it’s a Financial Industry Regulatory Authority regulation.

Commission-Free Trading

Traditionally, a fee is charged every time an individual trades stock. Fee-based trades can hurt overall investments, especially for people who trade frequently.

At Robinhood, all stock, options, ETF, and cryptocurrency trades are commission-free. It’s a fantastic opportunity for newbie investors to try their hand at trading without fees eating into their hard-earned cash.

High-Yield Savings

Smart investors know they shouldn’t put everything they have into trading. Robinhood has you covered with its high-yield savings account. They offer 0.3% for any money you have sitting in their savings account.

A savings account with Robinhood has plenty of perks. You’ll be given a debit card and can withdraw your cash for free at over 75,000 ATMs. You’ll also be FDIC insured up to $1.25 million.

There’s a small catch to Robinson’s high-yield savings account—you’ll be put on a waitlist. According to their website, it’s unclear how long the wait is, but they open spaces weekly for people on the waitlist.

To sign up for Robinson’s savings account waitlist, you need to already have an approved brokerage account with them.

User-Friendly

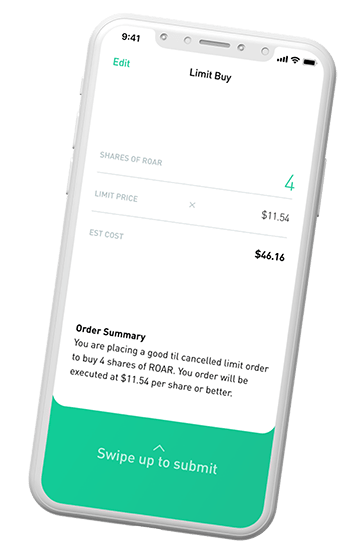

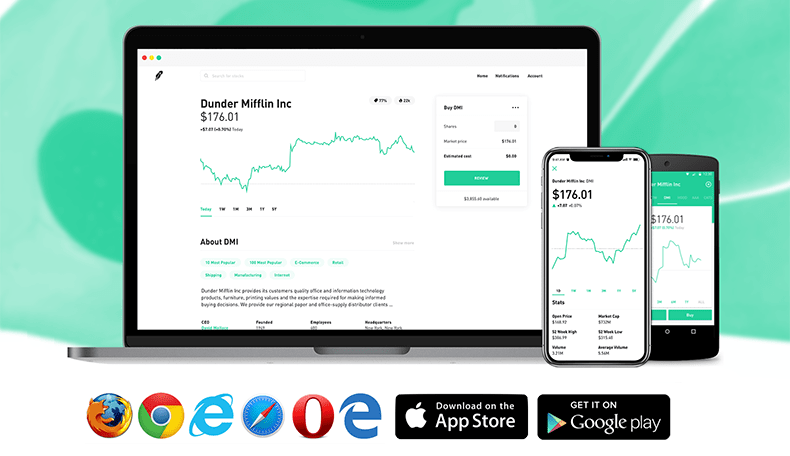

Robinhood.com offers trading on their website, but their app is where they shine. The app is easy to navigate and understand for people new to investing, especially since it isn’t cluttered with hard to understand charts.

You can make market orders, limit orders, stop-limit orders, and stop orders from the app. There’s also a feature to compare stocks side by side.

Other features of the Robinhood app include a tab bar at the bottom of the app. Here, you can quickly check your transaction history, account statements, watch lists. And, of course, the all-important portfolio balance.

It only takes a few minutes to set up a Robinhood.com account. The questions they ask are simple. You can even set up your bank account, so automatic deposits are made to Robinhood weekly, biweekly, monthly, or quarterly.

Added Features

Robinhood is designed for entry-level investors, but this doesn’t mean that it’s devoid of useful investment tools. You’ll have access to lists with top movers, analyst ratings, candlestick charts, and news feed. You can also set up the app so you receive alerts.

Robinhood Instant

Traditionally, when a person deposits money into their brokerage account, it takes a few business days for the money to clear. In other words, that money is unusable for trade during that time.

With Robinhood, you can immediately trade with up to $1,000 as soon as you make a deposit. That’s a huge advantage for investors as time waiting for money to clear can cost them many missed opportunities.

If you transfer more than $1,000 into your Robinhood account, any amount over $1,000 will be available to trade once the money arrives in your account.

Cryptocurrency

In its efforts to remain a leading online brokerage company, Robinhood has incorporated cryptocurrency trading into its system.

Cryptocurrency has its own set of rules, but Robinhood has secured cryptocurrency trading for nearly every U.S. state. Nonetheless, you should double-check to ensure your state qualifies for Cryptocurrency trading on Robinhood.com.

You’ll be able to trade some of the biggest crypto names on the market, such as Bitcoin and Ethereum. They also offer the option to trade smaller coins like Dogecoin and Stellar.

Devices compatible with Robinhood.com

The beauty of Robinhood is in its user-friendly app. The app is compatible with iOS 11 or newer software and Android running 6.0 Marshmallow or newer. Technically, the apps are designed for mobile devices only, but they typically work well on tablets.

If you don’t have a smartphone or want to use a larger screen, you can use Robinhood Web. Their website is supported by all major browsers, including Chrome and Safari, on Macs and PCs.

Robinhood.com Costs

We’ve already established that Robinhood.com operates on a commission-free basis, but you might be wondering: is there a catch?

Not quite, but there are a couple of things to keep in mind. The first is that there’s a $75 fee should you wish to transfer your Robinhood account to a different broker. Keep in mind that this is only for brokerage transfers—making an ACH transfer to your bank account is free.

Also, there’s the option to upgrade to a Robinhood Gold account. In this case, you’d pay a flat fee of $5 per month. In exchange, you’ll be able to trade on margin (borrowed money).

Requirements to Set Up a Robinhood.com Account

Setting up a Robinhood account is easy, but you’ll need to meet a few minimum requirements. They include:

- Be a U.S. citizen, permanent resident, or have a U.S. visa.

- Have a legal U.S. address within the United States or Puerto Rico.

- Be at least 18 years old.

- Have a social security number.

If you meet the requirements above, you’ll be eligible to submit an application to open your Robinson account. The application questions are basic, and the process should only take a few minutes.

Within one trading day, you should receive an email. The email will accept you as a Robinson member or ask for follow-up information if anything is unclear.

It’s possible to link your bank account and make a deposit to Robinhood.com before your application is approved. In this case, Robinhood will hold off on initiating the bank transfer until your account is accepted.

Customer Support

Robinhood is designed as an app-based trading app, and this shows through when it comes to their customer support—any help you need will be done entirely online.

Their Robinhood Support online center is user-friendly, and you’re welcome to communicate with them via email.

Robinhood.com Regulation

As a securities brokerage, Robinhood is regulated by the Securities and Exchange Commission and a member of the Financial Industry Regulatory Authority (FINRA). The funds you have in your Robinson account will be protected up to $500,00 for securities and $250,000 for cash claims.

Wrap Up

Robinson.com is a competitive online brokerage company. Thanks to its user-friendly design and commission-free structure, it’s an excellent option for first-time investors to dip their toes into the investing world.